capital gains tax increase 2022

Last years tax gains. For example if a taxpayer made 900000 from their salary and 200000 from LTCGs then 100000 of the LTCG would be taxed at the favorable 20 rate.

Taxtips Ca Manitoba 2021 2022 Personal Income Tax Rates

The standard deduction for married couples filing jointly for tax year 2022 rises to 25900 up 800 from the prior year.

. When including the net investment income tax the top federal rate on capital gains would be 434 percentRates would be even higher in many US. President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent today to 396 percent for higher earners. One large reason for the influx in property sales is the projected increase in capital gains taxes for 2022.

President Biden recently announced his plan to double the long-term capital gains tax rate for those at the top from 20 to 40. Short-term capital tax gains are subject to the same tax brackets for ordinary incomes taxes in 2022. The Democrat-led state Legislature approved a 7 tax on capital gains over 250000 early in the year.

Five 5 percent for individual overpayments refunds. 7 hours agoFilers paid hundreds of billions more in taxes for 2021 and surging capital gains may have been to blame according to an analysis from the Penn Wharton Budget Model. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

For single tax filers you can benefit from the zero percent. President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396. Capital gains tax would be increased to 288 percent.

The proposed budget would increase the taxes on capital gains for Americans earning more than 1 million to 434 which makes the rate the same as these individuals regular income tax rate completely eliminating the tax benefits of capital gains. Nonetheless many sellers are looking to secure a sale before 2022 because of the possibility that any sale following 2022 could fall into a new tax bracket. As of now the tax law changes are uncertain.

There is currently a bill that if passed would increase the capital gains tax in. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. If you own a business and youre considering selling you need to plan for.

If a capital gains tax increase is enacted advisors will encourage many clients to try and sell assets as soon as they can. 4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term capital. Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently.

Ordinary income brackets begin at 10 percent and increase incrementally to 37 percent. When you include the 38 net investment income tax NIIT and some state income taxes you could be looking at a 48 all-in capital gains tax rate by January 1 2022. The table below breaks down long-term capital gains tax rates and income brackets for tax year 2021.

2 Proposed Biden Retroactive Capital Gains Tax National axpayers Union ondation Could Be Challenged on Constitutional Grounds levying a 10 percent surtax on high earners6 imposing a one-time 25. Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status. In addition to raising the capital-gains tax rate House Democrats legislation would create a 3 surtax on individuals modified adjusted gross income exceeding 5 million starting in.

Additionally a section 1250 gain the portion of a gain. It means that when capital gains taxes most assuredly will increase from the current maximum 20 to 396 in 2022 under the Biden administrations plan you will be paying almost double the tax on the sale of your business. 4 rows If you sell stocks mutual funds or other capital assets that you held for at least one year any.

While it technically takes effect. Households owed more than 500 billion in taxes when they filed their returns this year an increase of about 200 billion from immediately prior to the pandemic. For single taxpayers and married individuals filing separately the standard deduction rises to 12950 for 2022 up 400 and for heads of households the standard deduction will be 19400 for tax year 2022 up 600.

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. Still another would make the change. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held.

According to a house ways and means committee staffer taxpayers who earn more than 400000 single 425000 head of household or 450000 married joint will be subject to the highest federal tax rate beginning in 2022. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. The standard deductionwhich is claimed by the vast majority of taxpayerswill increase by 800 for married couples filing jointly going from 25100 for 2021 to 25900 for 2022.

The large tax liability owed at filing is mostly the result of a surge in capital gains and other income from financial assets in 2021. Gains from the sale of capital assets that you held for at least one year which are considered long-term capital gains are taxed at either a. Starting in 2022 at least a portion of Long Term Capital Gains LTCG and Qualified Dividends will be taxed at ordinary tax rates for those whose adjusted gross income is more than 1 million.

Reduced the maximum capital gains rate from 28 percent to 20 percent.

10 Genuine Ways To Increase Domain Authority The Sense Mission In 2022 Mission Senses Website Making

9 Great Ways To Understand Mutual Funds In 2022 Retirement Money Low Risk Investments Investment Advisor

How To Avoid Capital Gains Tax On Rental Property In 2022

Capital Gains Tax In Canada Explained

Selling Stock How Capital Gains Are Taxed The Motley Fool

What Are The New Capital Gains Rates For 2022

How Can Videopal Help You In Your Business Bufeez In 2022 Boosting Sales Helpful Business

The 7 Income In 2022 Dividend Income Digital Entrepreneur Rental Income

Pin By Lucy On Political Capital Gains Tax Inheritance Tax Social Care

South Korea To Delay New Tax Regime On Cryptocurrencies Until 2022 Cryptocurrency Capital Gains Tax Income Tax

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Canada Capital Gains Tax Calculator 2021 Nesto Ca

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

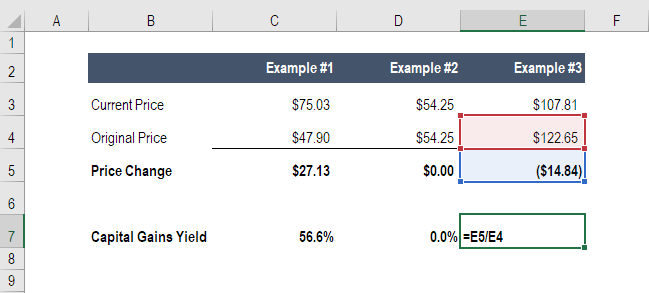

Capital Gains Yield Cgy Formula Calculation Example And Guide

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)