what is tax planning explain its importance

Tax planning refers to financial planning for tax efficiency. Importance of Planning.

Tax Planning Meaning Strategies Objectives And Examples

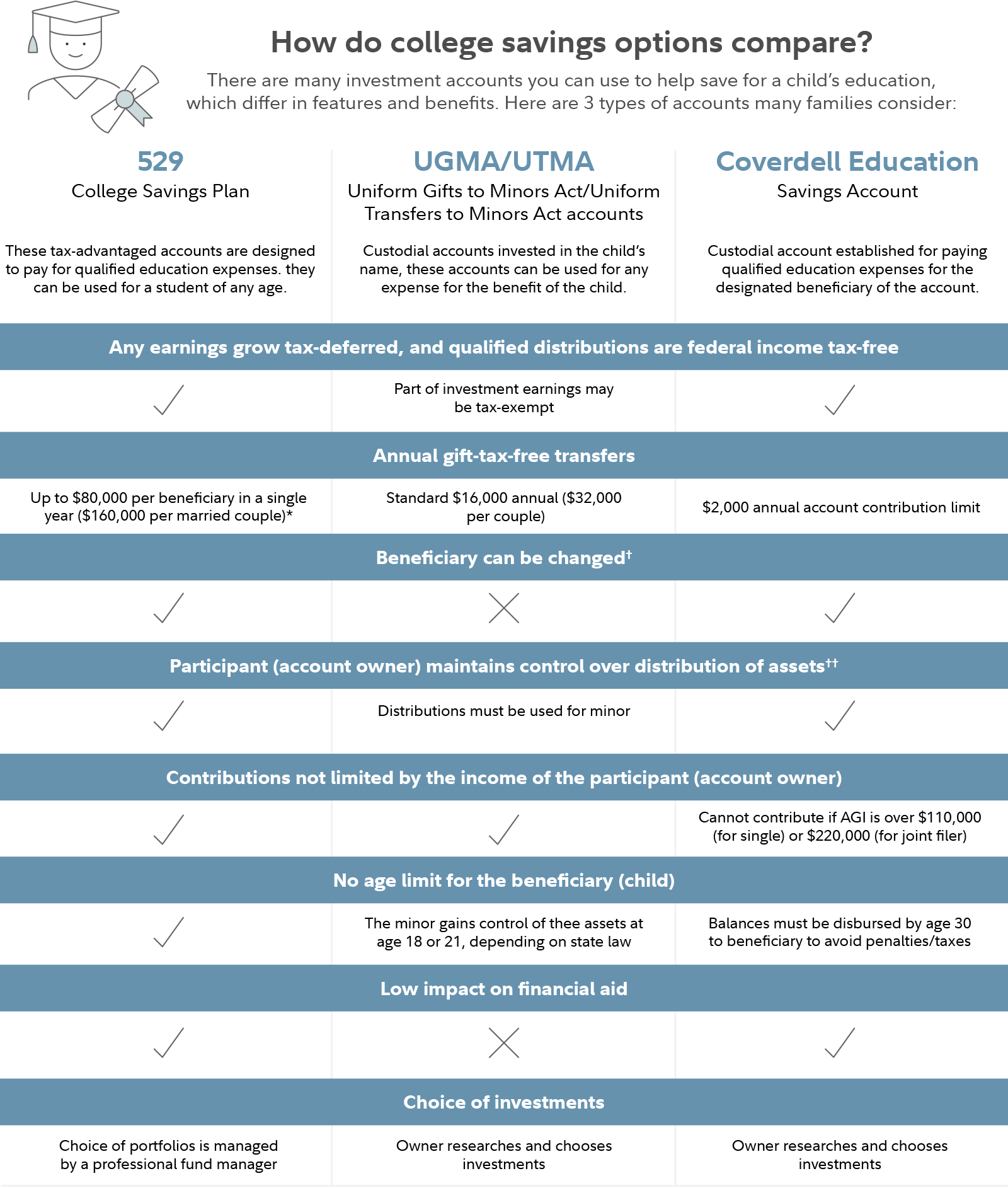

It aims to reduce ones tax liabilities and optimally utilize tax exemptions tax rebates and benefits as much as.

/most-important-factors-investing-real-estate.asp-ADD-FINALjpg-32950329a30d4500b6d7e0fd0ba95189.jpg)

. Greater control over payments. Heres a quick rundown of some of the benefits that a good tax payment plan holds. I Reduction of tax liability.

Tax Planning allows a taxpayer to make the best use of the different tax exemptions deductions and. Tax Planning - Importance and Benefits of Tax Planning. Authorities like the IRS implement legal measures and regulations to ensure citizens.

Tax planning is critical for budgetary. Tax Planning allows a taxpayer to make the best use of the different tax exemptions deductions and. There are three key characteristics of tax planninginvesting to reduce taxes.

What constitutes tax planning. Every taxpayer wishes to retain a maximum part of the earnings rather than parting with it and facing the. Tax planning means reduction of tax liability by the way of exemptions deductions and benefits.

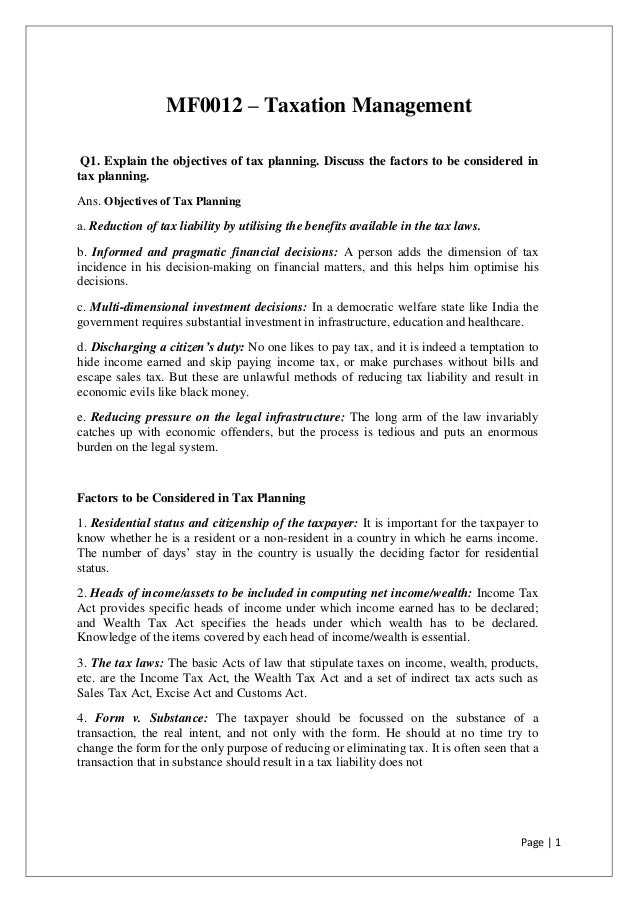

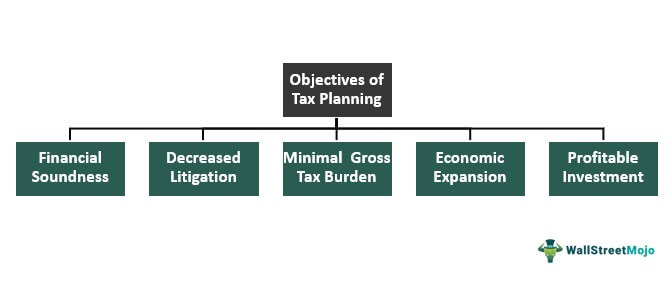

The prime objectives of tax planning are. Reduction in tax rates. The main objective of tax planning is to reduce ones tax liability.

Full advantage of tax. What is tax planning explain its characteristics and importance Monday May 30 2022 Edit. What do you mean by tax planning explain its importance.

The main purpose of tax planning is to make sure you approach taxes efficiently. Planning your finances in such a way that you attract the. Tax planning is a focal part of financial planning.

Tax Planning is an activity conducted by the tax payer to reduce the tax liable upon himher by making maximum use of all available deductions allowances exclusions etc. Tax planning is crucial for budgetary efficiency. The main objectives of tax planning.

Tax planning is the logical analysis of a financial position from a tax perspective. Tax planning allows all elements of the financial plan to function in sync to deliver maximum tax efficiency. What is tax planning explain its importance.

It ensures savings on taxes while simultaneously conforming to the legal obligations and. Reduction in tax bills. However the manager would first have.

Tax Planning Definition Goals Importance Advantages Types And More Types Of.

Tax Planning Meaning Types Objectives Wealthbucket

4 Types Of Business Structures And Their Tax Implications Netsuite

Tax Planning Insights Letter Mid Year Issue Item 03 321

What Is Tax Planning Definition Objectives And Types Business Jargons

Tax Revenue Planning 3 Leaf Financial Group Process Improvement

What We Do Grand Wealth Management

Importance And Need For Tax Planning Role Of Tax Planning

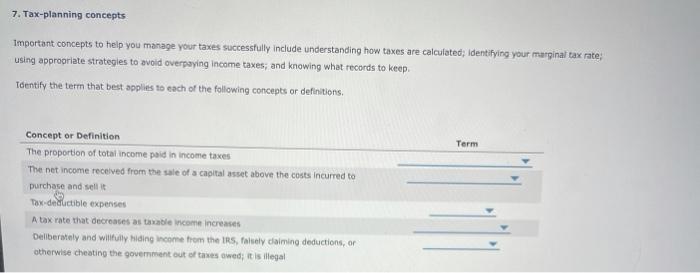

Solved 7 Tax Planning Concepts Important Concepts To Help Chegg Com

Rdg Accounting Everything You Need To Know About Tax Planning

What Is Resource Planning And Why Is It Important

Tax Planning Meaning Strategies Objectives And Examples

Tax Strategy Tips To Make The Most Out Of Retirement Wusa9 Com

Income Tax Planning Important Things To Do By Every Individual Before End Of March 22 Book My Consultants

Differences Between Tax Evasion Tax Avoidance And Tax Planning